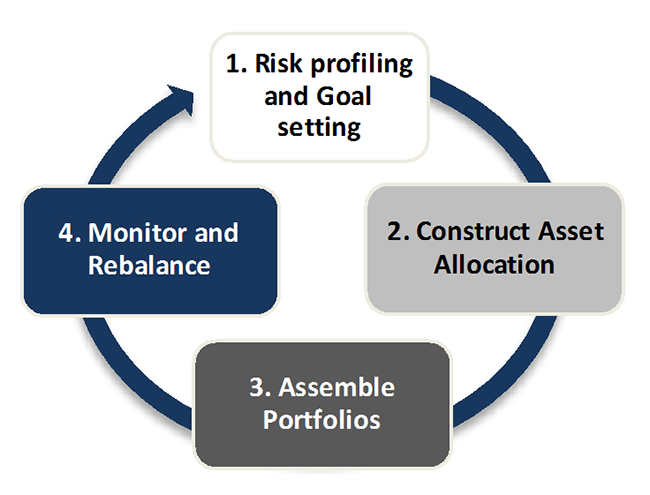

1. Risk Profiling And Goal Setting

We use our propriety behavioural finance models to understand you and assess your risk appetite. Risk Profiling is one of the most crucial aspects of the whole process. Goals are set as per your current financial position, risk tolerance and investment horizon.

2. Construct Asset Allocation

This is Your Personalized plan!

All asset classes are cyclical in nature. Our research helps you identify the suitable asset class

for your risk profile in the light of the given financial scenario. Considering the asset classes so

identified, the plan is then customized as per your aspirations for your wealth, taking into account

the factors acknowledged in the first step.

3. Assemble Portfolio

All the options available in the market in the respective asset segments, showcased by various product manufacturers have to be thoroughly assessed and evaluated for their risk-return metrics. At Accrue Finvisor, we carry out the above-mentioned assessment with an unbiased approach to conclude what suits you the best and ensure a hassle-free tech-based online investment methodology for the same. We consider the tax profile of each individual in the family in order to make the solution tax efficient.

4. Monitor And Rebalance

Like a CFO does for a company, we use Ratio analysis in order to monitor key financial variables like asset allocation, reserves, surplus, liquidity, debt, solvency for you on a monthly basis. This helps in rebalancing the portfolio without any undue delays. Rebalancing acts as an oil change to the ongoing maintenance of a car. The primary objective kept in mind while rebalancing your portfolio is to ensure that its performance is not dependent on a particular investment or asset class, to establish better risk control and to enable you to reach your goal within the set time frame.